10 Finest Cash Advance Programs In Order To Help An Individual Help To Make It To Payday

- Posted by admin

- On 1 janvier 1970

- 0 Comments

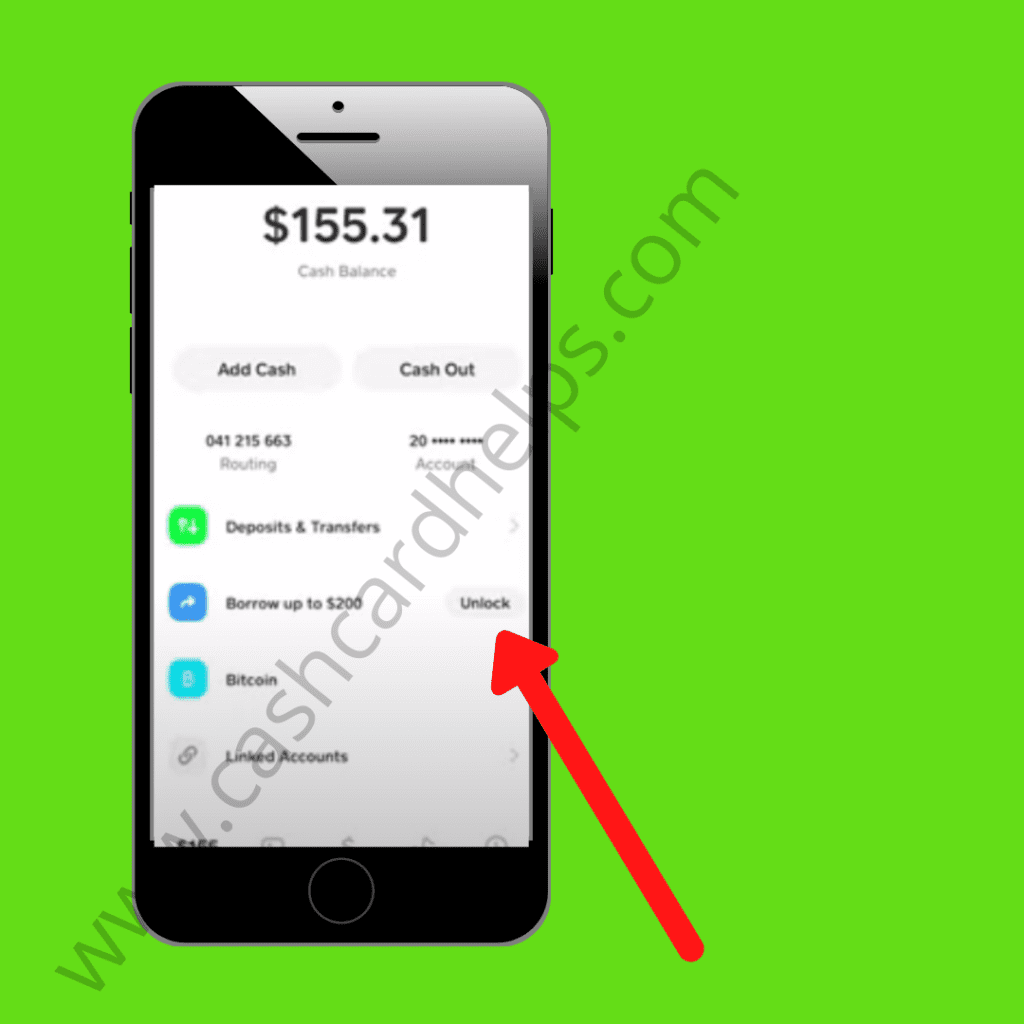

- can you borrow money on cash app, cash app borrow limit, how to borrow $200 from cash app

Cash advance apps are not regarded as payday lenders, plus payday lending regulations don’t use to be capable to these people. Here are usually the particular top cash advance applications that allow you borrow towards upcoming income, plus other applications that will might become correct in some situations. You might furthermore have access to a funds advance about your credit rating card or the capability to become able to employ a buy-now-pay-later plan. It’s compensated back, with or without a payment, any time you get that will paycheck. It may come anytime throughout your own pay time period, but generally 1 in buy to a pair of days inside advance. A private loan offers a lot lower attention plus more controllable obligations than a payday mortgage, which is usually because of in a group sum.

Software: Less As Compared To 35 Minutes

Payday loans offer you access in order to upcoming repayment from your employer. Within many instances the particular payday lender needs resistant of income for example a prior pay stub. On The Other Hand, payday loans may end upwards being incredibly predatory, plus should end upwards being avoided. When you’re going through a great unpredicted unexpected emergency expense and don’t possess the financial savings to deal with it, a cash advance on-line may possibly be 1 alternative that could assist a person out. Merely remember that it’s essential in order to borrow reliably and understand the conditions in inclusion to circumstances associated with a loan prior to applying.

Money Advance Credit Credit Card Alternatives

That approach, typically the subsequent time you get paid, typically the software will automatically pay off typically the immediate cash advance with regard to a person. Most money advance applications automatically deduct repayments any time a user’s paycheck strikes their own financial institution bank account. Make Sure you’re able to become able to meet typically the repayment conditions without impacting your money flow, as faltering to be able to carry out therefore could lead in buy to overdraft problems or extra charges. Yet if an individual possess bad credit score in add-on to don’t be eligible with regard to a individual mortgage, try a zero-interest funds advance application — or a payday mortgage being a previous vacation resort. Cleo is a cost management plus cash advance app of which allows an individual borrow up to be capable to $250 between paydays.

- At Times, the particular $100 or $250 reduce on payday advance applications isn’t sufficient to become capable to protect all your current expenses.

- With Regard To Undisclosed a calendar month, Dave exchanges money in purchase to your bank bank account within just three business days and nights.

- These Types Of money advance in add-on to personal financial loan apps permit a person entry quick cash to be capable to protect unforeseen costs.

- Hardship loans usually are tiny personal loans intended to become able to help folks together with short-term monetary problems, such as health care bills, vehicle repairs or house emergencies.

- The selections for the particular greatest fast loans serve in order to borrowers around typically the credit score spectrum plus could have money in your own bank account the particular exact same day time an individual utilize or the next enterprise day time.

Right After you’ve verified your own Instacash sum, your own funds will be upon their own way! Once these people appear, an individual could use them exactly how a person notice match – whether you need to be able to pay bills, handle an unexpected emergency, or protect daily expenditures. If your employer lovers together with Payactiv, that’s your current finest bet regarding low-fee access to end upward being able to your own earned wages. When an individual may use typically the some other tools presented along with the Enable application, typically the subscription charge might be well worth it regarding an individual.

A Person usually carry out not have got to wait regarding banking institutions to become able to available, or regarding lengthy authorization techniques. A Person get a great quick response in addition to quick cash (or cash placed directly into your current accounts as typically the situation may be). The Particular even more account choices and other features they offer, the particular much better. Quick advancements typically price more when the funds strikes your bank account just as a person authorize the particular transfer. A Person may move the cash in buy to your current financial institution account, load it to become capable to a Payactiv Visa prepay cards, or receive it inside funds with a Walmart Money Center. There’s a $1.99 charge with regard to money pickup plus quick deposits to playing cards other as in comparison to the particular Payactiv credit card.

You could pre-qualify on the internet within just minutes by simply offering a few simple info about yourself, which includes your own tackle, earnings plus Interpersonal Security quantity, as well as typically the mortgage quantity and purpose. Pre-qualifying allows you evaluate rates through several lenders plus locate the particular the really least expensive mortgage, thus it’s a stage you shouldn’t skip, actually in case an individual require funds quickly. Typically The greatest personal loans regarding emergencies are through trustworthy lenders that may account the particular mortgage quickly. Our Own selections regarding the particular greatest fast loans accommodate in purchase to borrowers throughout the credit rating variety and may have funds in your current account typically the same day you utilize or the particular following enterprise day time. If you have very good to end up being capable to outstanding credit score, LightStream is usually a single regarding the best alternatives regarding an emergency mortgage. It’s recognized with consider to getting aggressive prices, no origination costs, fast money, higher financial loan quantities plus repayment versatility.

Upstart individual loans offer quickly money and might end upward being an option for borrowers with lower credit scores or thin credit score reputations. Finder.com is usually a great self-employed evaluation system plus information service of which seeks to provide a person together with the particular resources you want to become able to make much better decisions. While we all are usually independent, typically the gives that seem upon this particular web site are usually coming from companies through which usually Finder gets compensation. All Of Us might obtain settlement coming from our partners for placement regarding their particular products or providers.

Brigit customers also acquire access to identification theft protection plus additional monetary resources to aid degree upward their particular financial health how you borrow money from cash app. Payday lenders and the like are usually identified with regard to getting mega-high prices, usually exceeding beyond 700% APR or more. Money programs never charge attention about just what a person borrow — in inclusion to you simply borrow against your upcoming earnings, which can aid maintain an individual away associated with a cycle regarding debt. Within Just every significant group, all of us also regarded many characteristics, which include optimum loan sums, repayment phrases, in add-on to relevant costs.

Pros And Cons Of Applying Funds Advance Apps Along With Zero Credit Examine

Dave doesn’t charge attention or late fees, in addition to tips usually are recommended. A Person could likewise employ a funds advance app along with 0% curiosity, even though they will occasionally demand a month to month membership in inclusion to fees with respect to quickly exchanges. Funds advance applications in add-on to payday lenders the two offer you small loans that will are usually generally compensated out of your own subsequent income.

The Particular borrower gives a post-dated individual verify or agreement for a upcoming electronic withdrawal. Although they’re referred to as payday loans, the particular funds may furthermore end up being secured by simply additional revenue, for example a pension or Sociable Safety verify. You’ll pay compounding attention upon the advance through the particular very first time the particular funds is prolonged, plus a good up-front support fee. Furthermore, the vast majority of credit rating cards firms just make a section of your current revolving credit score collection obtainable regarding a money advance. This Particular quantity will be often imprinted upon your month to month statement or noticeable when a person record into your bank account on the internet.

Avant: Finest Regarding Next-day Financing With Regard To Bad-credit Borrowers

All Of Us also evaluated each provider’s client assistance, borrower incentives and reviews. Whilst a money advance app may end upward being helpful, it isn’t a great solution for addressing daily expenditures or other ongoing charges since the costs could rapidly include upwards. Empower is a fintech application that will gives funds improvements upward in buy to upwards to $300 in add-on to a credit-building collection regarding credit rating called Flourish. Brigit costs $8.99 to be able to $14.99 for each 30 days, depending about which strategy you select. This month to month cost may possibly not necessarily become worth it in case a person simply need periodic cash advances and don’t get advantage associated with Brigit’s additional functions.

Greatest Financial Loan Programs Regarding Funds Advances And Overdraft Protection

Yet it could likewise consider a day or 2 to confirm your current identification, build up plus other banking action prior to you can request a good advance. Cleo won’t demand any type of interest or late costs, nonetheless it includes a $5.99 subscription payment. In Contrast To several other applications, Cleo allows an individual select your own own repayment date, although it must become within just 14 days regarding borrowing. Money advance apps usually require users to offer private financial details, connect a financial institution accounts or also supply their own Social Security amount. While many financial loan programs are safe in order to make use of, it’s important in buy to read on-line reviews in add-on to choose a trustworthy application of which will take protection critically. Atomic Invest furthermore shares a percent regarding compensation acquired coming from margin interest plus free cash curiosity gained by simply clients along with NerdWallet.

- He Or She contains a master’s within British from Ca Condition University, Extended Seashore.

- Due To The Fact Brigit costs a month-to-month membership fee, it may only make sense to end upward being capable to employ the app if you need the particular cost management in addition to credit-building characteristics.

- Those that merely started out a new work or possess a career offer you, think about your own choices as a brand new worker.

- A 401(k) mortgage can end up being a reliable option — in case you are usually willing to become capable to compromise some pension cost savings.

- Repaying your MoneyLion Instacash advance is usually simple in add-on to flexible.

Finest Funds Advance Programs Regarding Quick & Effortless Funds Loans

Through Modern Money Education, the lady demystifies economic planning plus investment decision techniques, producing these people both available plus doable regarding individuals coming from diverse backgrounds. The Girl practical, evidence-based teaching viewpoint enables persons to help to make knowledgeable economic decisions regarding the two immediate plus extensive planning. Angela is dedicated in purchase to the belief that will financial wellbeing is within everyone’s attain. The Girl workshops plus seminars supply a very clear, doable framework focused on the girl viewers’s unique needs, guaranteeing individuals acquire typically the knowledge plus confidence in purchase to follow their monetary goals. An recommend with respect to range and introduction in typically the financial organizing neighborhood, the girl positively supports endeavours to be able to expand access to end upward being in a position to economic education and learning, particularly among underrepresented organizations.

0 Comments